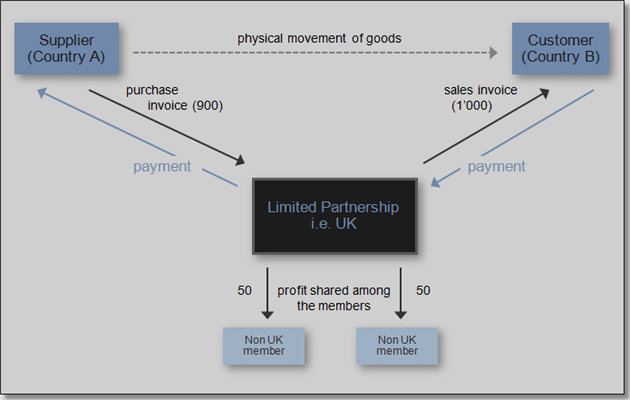

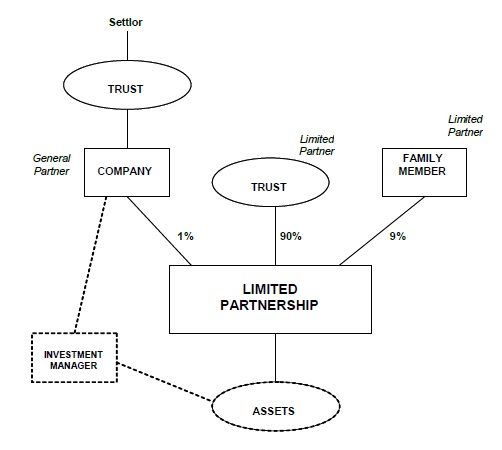

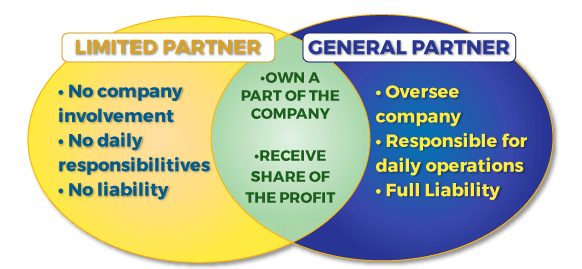

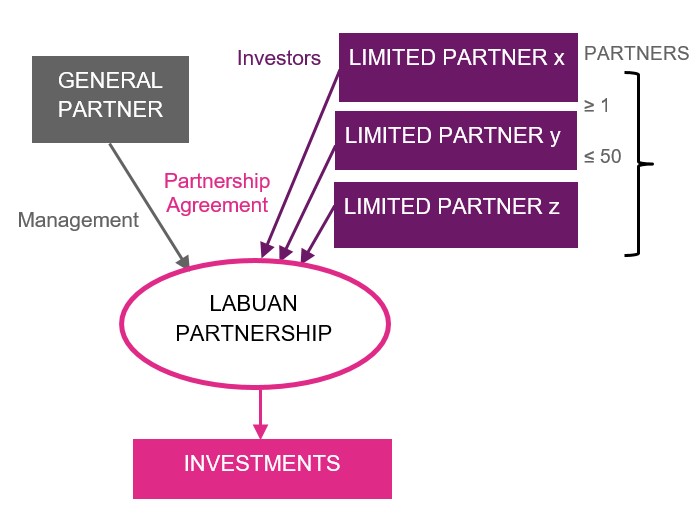

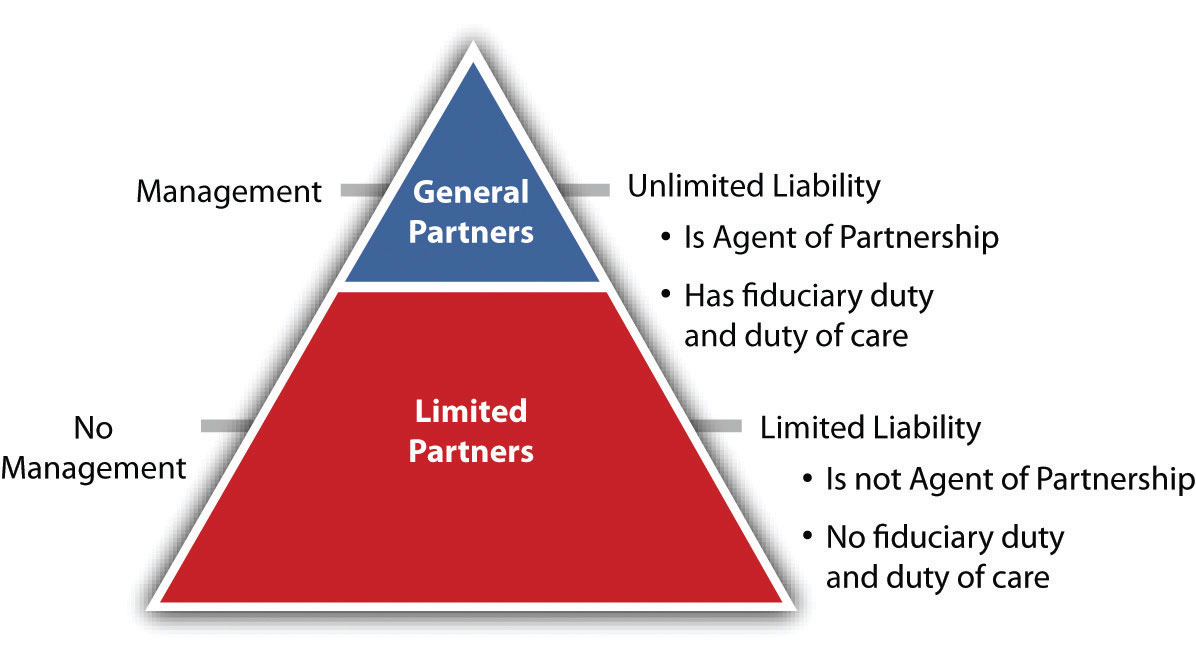

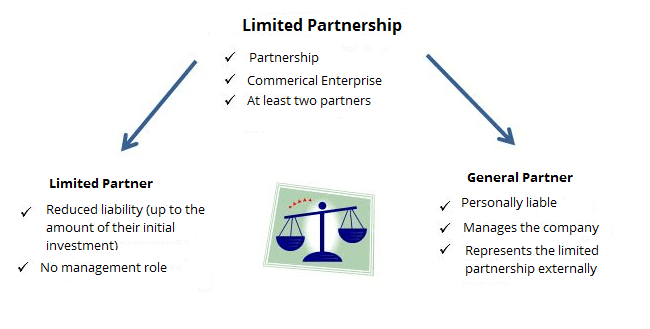

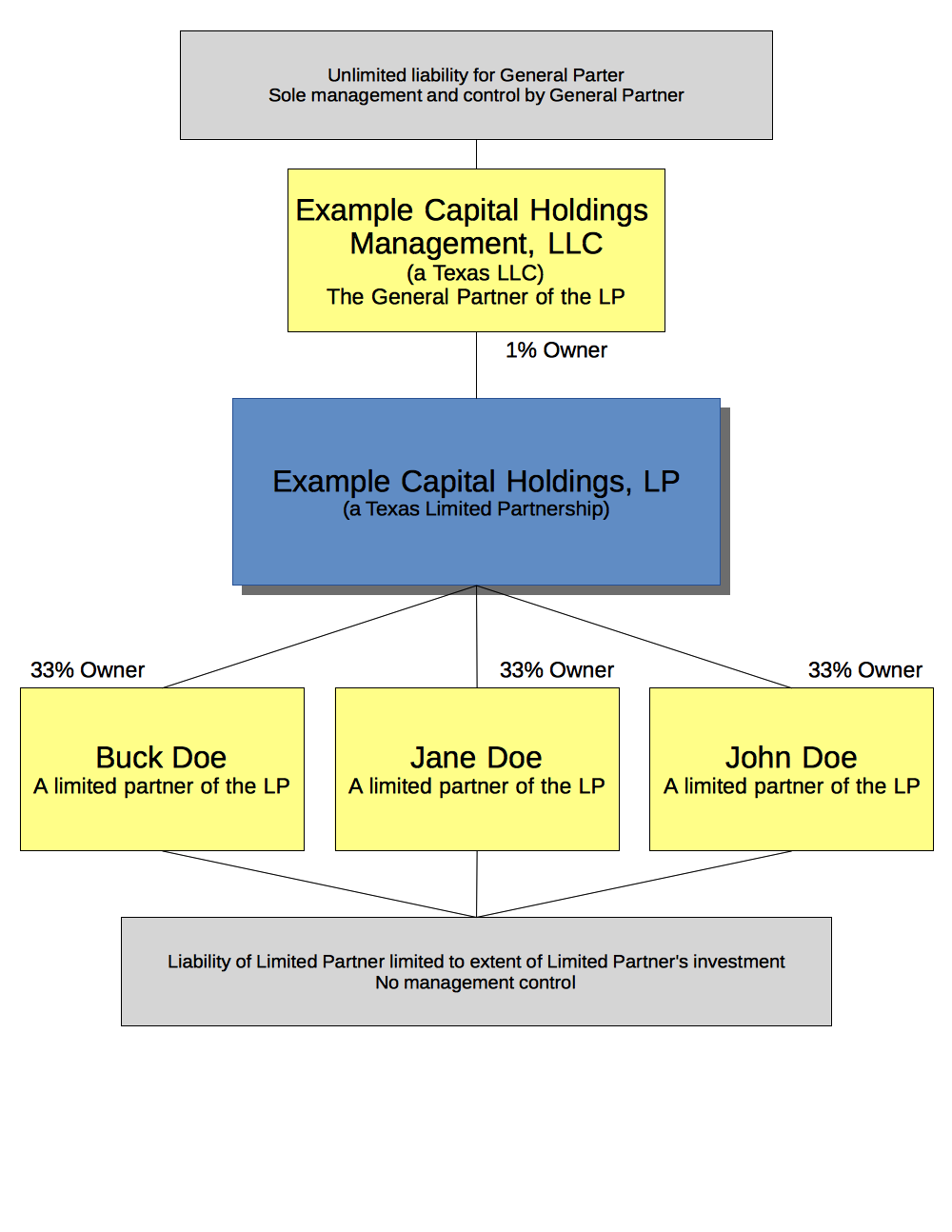

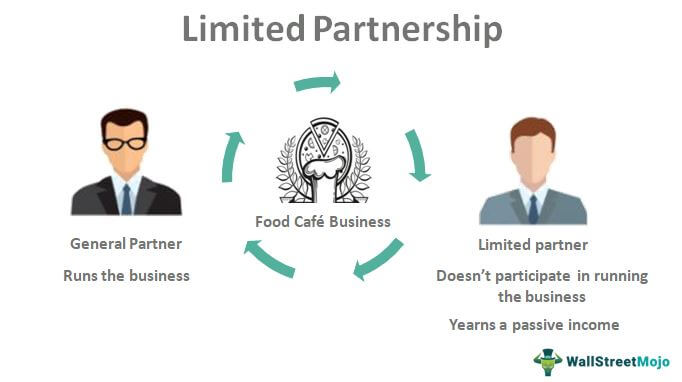

A Limited Partnership is a business entity that consists of one or more General Partners, whose responsibilities include daily management of the company, and one or more Limited Partners, who do not participate in management A General Partner may be an individual or an entity, such as a corporation In order to form a limited partnership, you must file a Certificate of Limited A limited partner is a partowner of a company whose liability for the firm's debts cannot exceed the amount that an individual investedWhen two or more individuals form an entity to undertake business activities and share profits with at least one person acting as a general partner as against to one limited partner who will have limited liability only up to the capital invested by such partner enjoying the benefits of less stringent tax laws is known as the Limited Partnership

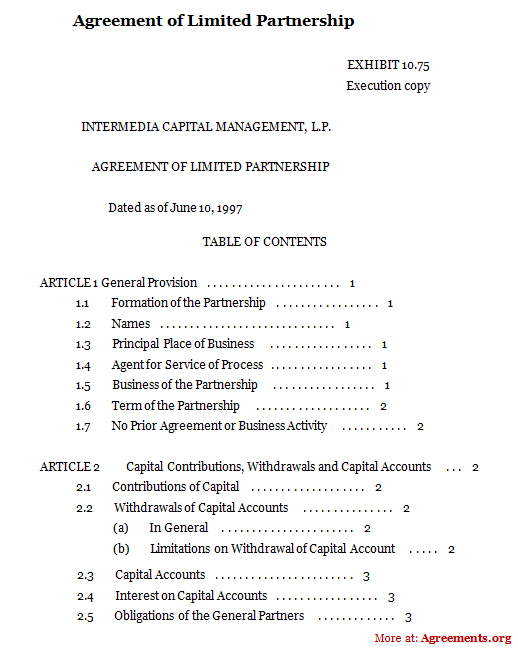

Limited Partnership Agreement Template By Business In A Box

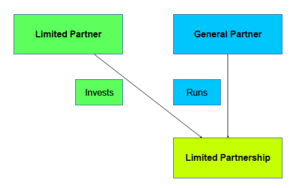

A limited partnership consists of

A limited partnership consists of- Limited partnership shares are considered securities The limited partnership interest that exist are considered to be securities This means the shares of a limited partnership can be sold to any third party in other to raise capital that has an equity percentage This removes the requirement for a company to go public in order to sell sharesInvesting in real estate is made possible by real estate limited partnerships (RELPs), which pool their funds to buy, develop, or lease property Corporations, property managers, and real estate development

Personal Liability In General And Limited Partnerships

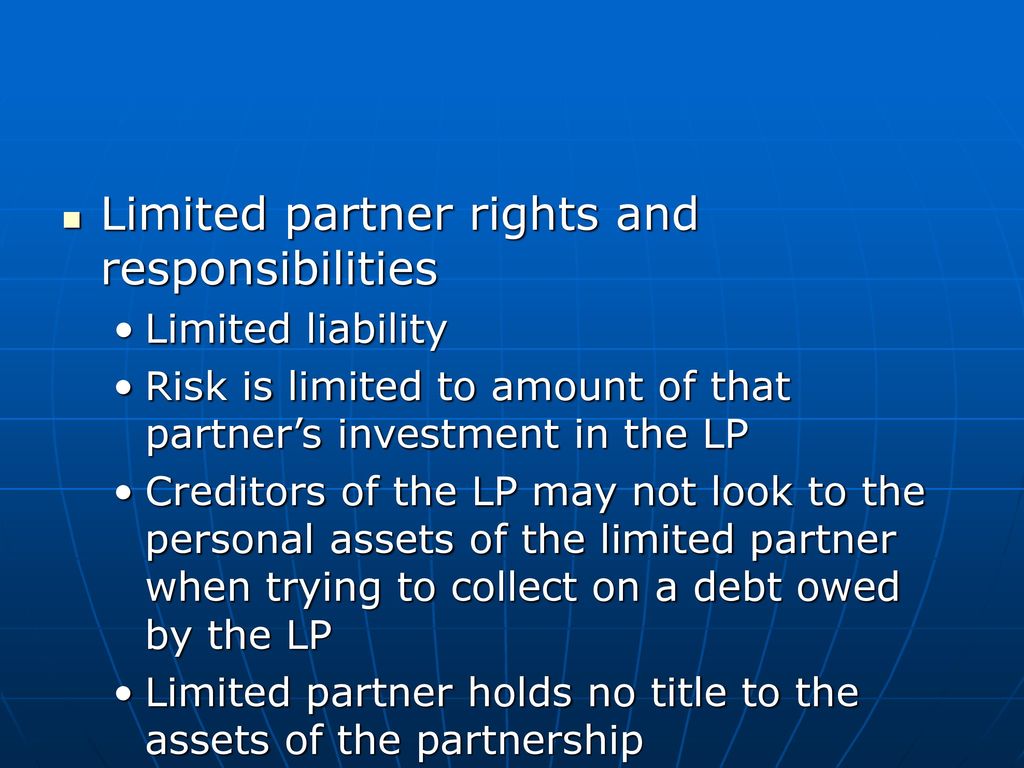

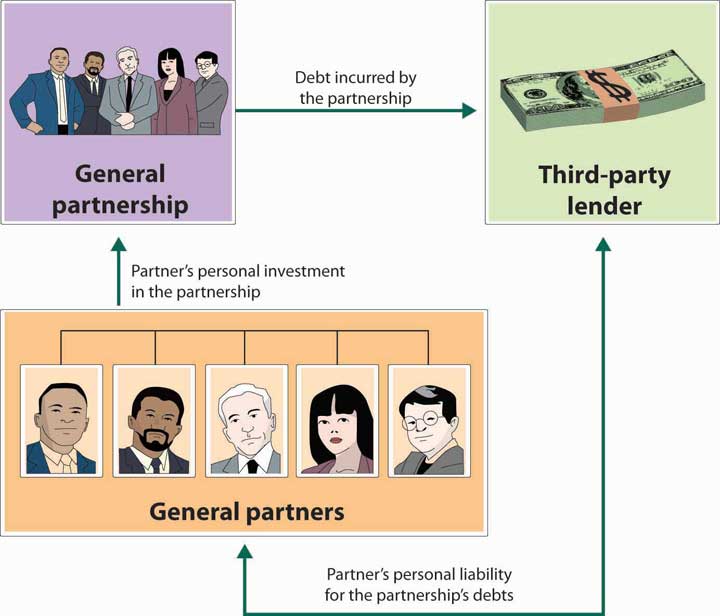

A limited partnership is a form of general partnership, which is one of three ways of organizing a business in Canada The other two are sole proprietorship and incorporationEach of these has its own operational, accounting, tax and legal requirements Limited Partnership Disadvantages One potential disadvantage of a limited partnership is that the limited partners have to avoid taking part in daytoday management of the company Otherwise, it's possible that creditors could successfully argue that they should be held personally liable for the company's debts A Limited Partnership RussiaChina Relations in the Mediterranean By Jim Townsend, Andrea KendallTaylor, David Shullman and Gibbs McKinley Print Download PDF Executive Summary The last several years have seen a worrisome increase in tensions in the Mediterranean involving ageold rivals such as Turkey, Greece, and Cyprus, as well as

Is An LP A Limited Partnership? A limited partnership is a type of partnership in which at the minimum one of the owners of a business is a limited partner and at least one of the other partners has limited liability, that is, he/she is a limited partner Unlike general partners who are involved in every aspect of the business from making day to day business decisions to being personally responsible for all the A limited partner can contribute financially to the business in exchange for a percentage of the partnership's profits A limited partner cannot incur the debts or obligations of the partnership in excess of the amount of capital invested into the business

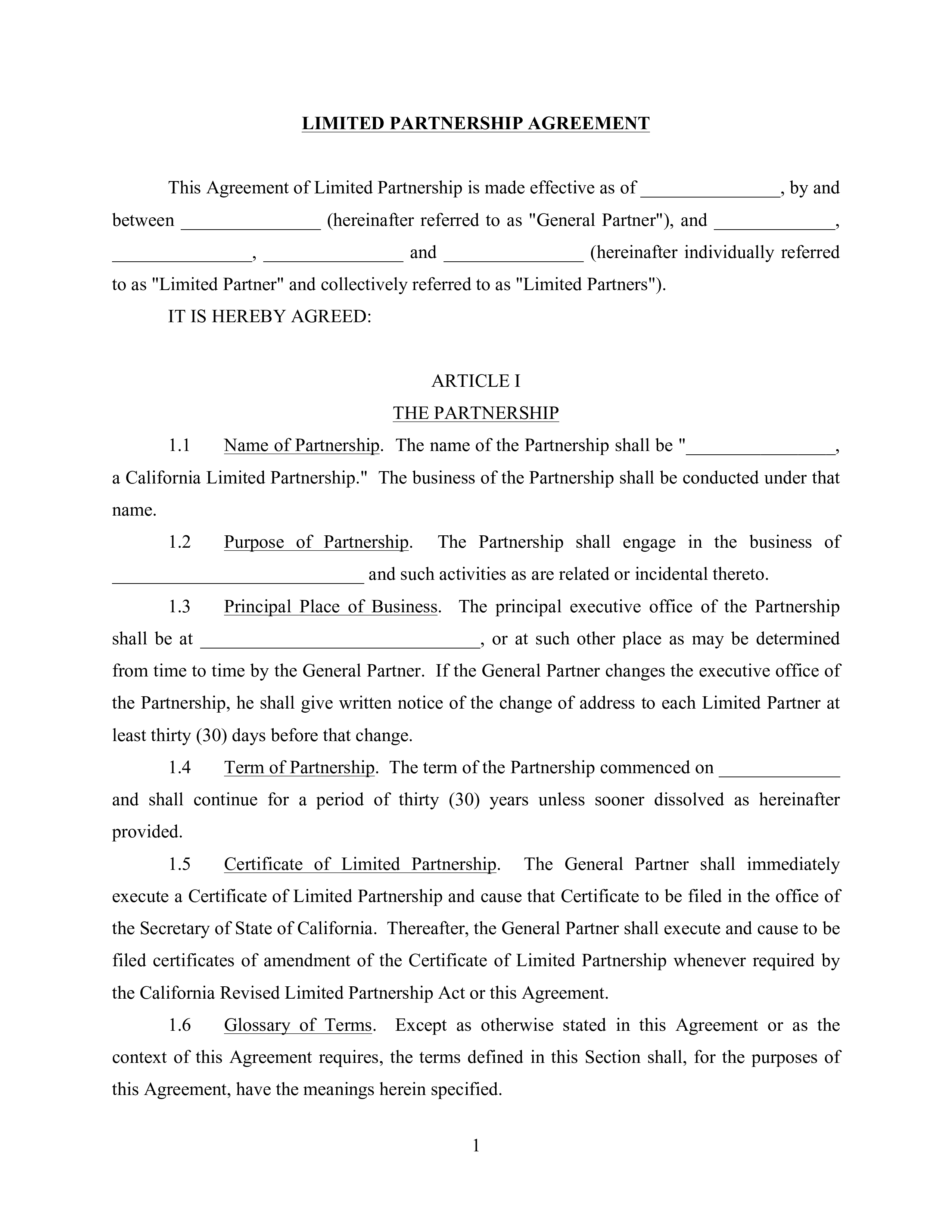

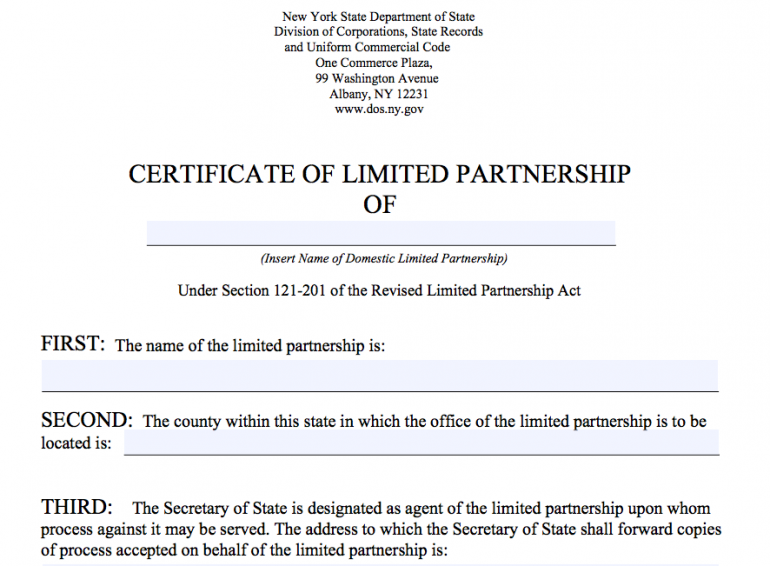

A Certificate of Limited Partnership is a document that must be filed with the state government (most typically with the Secretary of State), providing certain basic information about the limited partnership Many states have an official form that must be used to register your limited partnership There is a fee for filing, which varies by stateIn a Limited Partnership, creditors can reach all of the personal assets of the general partner so long as they follow appropriate measures The general partner in this partnership bears the brunt of the risk, but he or she also gets most of the power In most states, limited liability partners in such a relationship cannot be as actively involvedOn by Theo Jadiel Leave a Comment on Is An LP A Limited Partnership?

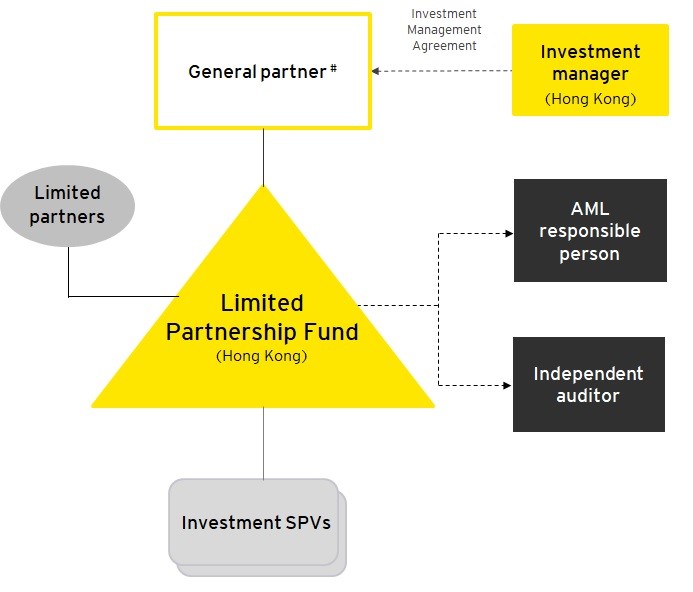

The Hong Kong Limited Partnership Fund Explained

The Increasing Popularity Of Private Funds International Bar Association

A limited partnership is a type of business partnership that involves a general partner responsible for the everyday operations and limited partners, whoCan a partner have 0 ownership?Table of Contents What does limited LP mean vinyl?

Limited Partnership Agreement Template By Business In A Box

File Chart Of A Limited Partnership Jpg Wikimedia Commons

What a limited partnership is Limited partnerships are a form of partnership involving general partners, who are liable for all the debts and liabilities of the partnership, and limited partners, who are liable to the extent of their capital contribution to the partnershipInformation about your limited partnership, including your addresses, and details for your general and limited partners, must be confirmed on the Limited Partnerships Register every year by filing an annual return If any details have changed, you need to update the register before you file your annual return Filing your annual return DEFINITION LLP is a corporate business vehicle that enables professional expertise and entrepreneurial initiative to combine and operate in flexible, innovative and efficient manner, providing benefits of limited liability while allowing its members the flexibility for organizing their internal structure as a partnership

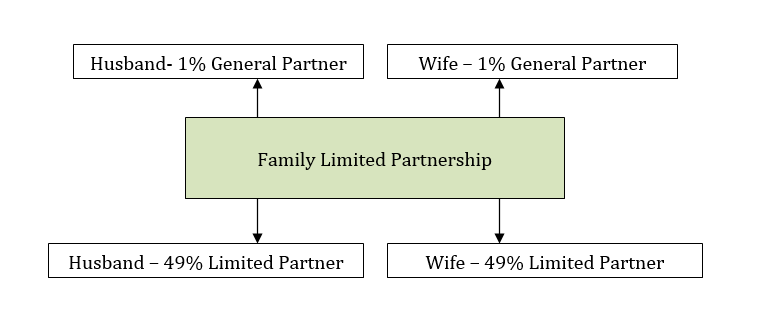

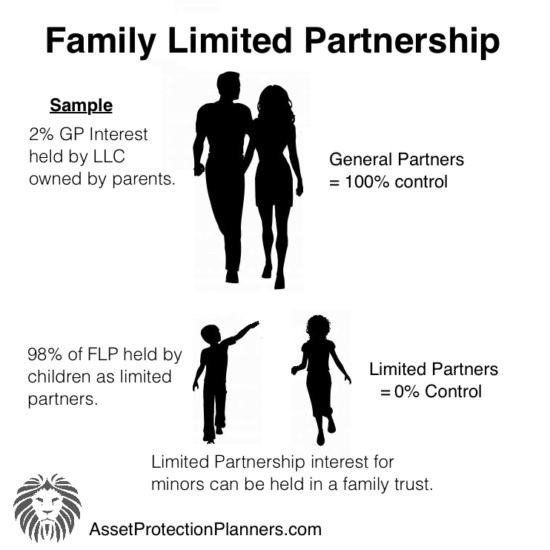

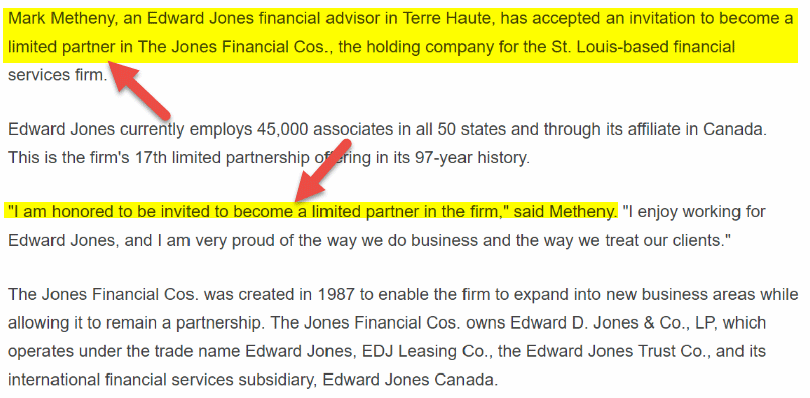

Family Limited Partnerships

Limited Partnership Lp Definition

A type of partnership with at least one general partner and at least one limited partner A general partner is responsible for managing the partnership but maintains personal liability for the partnership's debts A limited partner generally does not participate in managing the partnership, but enjoys limited personal liabilityLimited partnership a partnership under which it is possible for a person to become a partner upon terms that his liability to the creditors of the firm should be strictly limited (rather like that of a shareholder in a company) Such a person is in the position ofA limited partnership is composed of general partners and limited partners Limited partners can invest in the business and share its profits or loss, but cannot be active participants in the daytoday operations of the company A limited liability company can have as many owners (known as members) as it would like

Chapter 4 Limited Partnership Ppt Download

Chapter 15 1 15 Partnerships Formation Operation And

A limited partnership is different from a general partnership in that it requires a partnership agreement Some information about the business and the partners must be filed with the appropriate state agency (usually the secretary of state) Additionally, a limited partnership has both limited and general partners A limited partnership is an unincorporated business consisting of at least one general partner and one limited partner (also sometimes called a silent partner) General partners share in the profits and losses of the business, are involved in the daytoday management of the company, and are personally liable for the partnership's debtsLimited partnership tax treatment is similar to that of a general partnership, wherein business profits and losses pass through to the partners, who include their share of profits and losses in their personal tax returns However, the existence of limited partners in a partnership firm does have an impact on the individual tax liability of partners

Partnerships

Scottish Limited Partnerships Scottish In Name Only Bellingcat

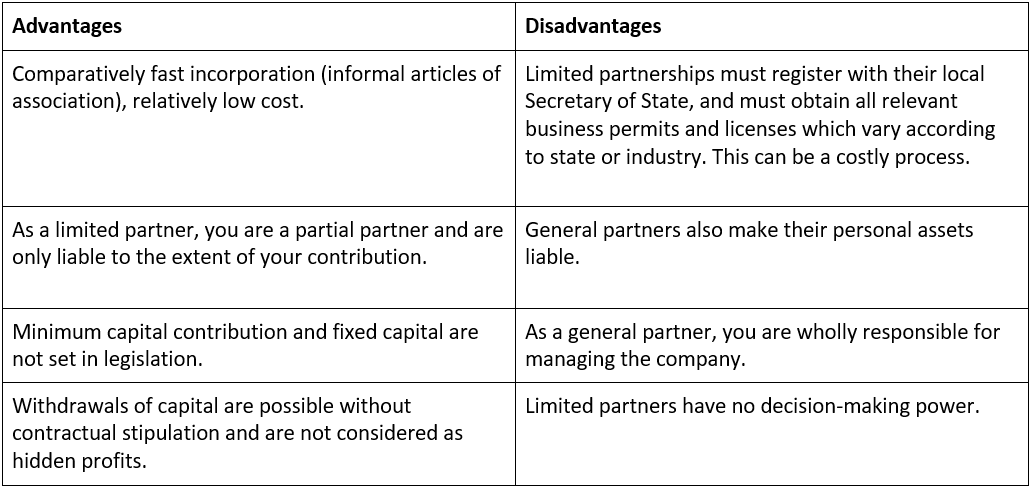

Limited partnerships, by definition, are also more complicated to set up than general partnerships, which form automatically when two partners go into business together To form a limited A limited partnership is a passthrough entity, which means the partnership itself doesn't pay taxes in the way a corporation would The partnership fills out Form 1065 as A limited partner is a limited partnership member who makes a contribution to the limited partnership and is only liable for the company's liabilities up to the amount of this contribution The general partner, on the other hand, is liable with all their assets Unless the articles of association determine otherwise, the limited partner is

2

The Family Limited Partnership

A limited partnership firm formed by general partners and limited partners, where the general partner (s) run the business and have liability and limited partner (s) has no daytoday involvement in the business decision making A limited partner's liability for a partnership firm is limited to the invested amount in the companyTemplates Is An LP A Limited Partnership?Business partnerships can take several different forms and there are advantages and disadvantages to each one that must be understood before entering into any partnership agreementMost partnerships are formed either as a limited partnership or a general partnership, and both offer specific advantages depending on what a potential partner is

How To Register A Limited Partnership In Ontario Obc Blog

Legal Service Limited Partnership And Limited Liability Partnerships

What Is A Real Estate Limited Partnership?Limited partnership A partnership registered in accordance with the Limited Partnerships Act 1907 An English limited partnership must be formed between two or more persons and must carry on a business in common with a view of profit Unlike a general partnership, a limited partnership has two categories of partner one or more general partner A partnership is the relationship between two or more people to do trade or business Each person contributes money, property, labor or skill, and shares in the profits and losses of the business Publication 541, Partnerships, has information on how to Form a partnership;

Limited Partnership Definition Harvard Business Services Inc

Limited Partners What Are Your Rights Mercer Capital

The legal structure of a limited partnership is outlined in the Uniform Limited Partnership Act 01 Limited partnerships are comprised of limited (silent) partners and general partners Limited partners are only responsible for contributing capital towards the enterprise and are only liable for debts up to that amountEaglenest Properties, A Limited Partnership is a Louisiana Partnership filed On The company's filing status is listed as Active and its File Number is JThe company's principal address is 333 Texas Street Suite 2300, Shreveport, LA and its mailing address is 333 Texas Street Suite 2300, Shreveport, LA4 Certificate of Limited Partnership In most states, you must file a certificate of limited partnership All general partners must normally sign the certificate The certificate generally requires at least the following information 1 The name of the limited partnership;

Personal Liability In General And Limited Partnerships

Limited Partnership Organizational Chart Ppt Powerpoint Presentation Layouts Examples Cpb Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas

Limited Partners One of the biggest advantages for a limited partner in the Limited Partnership is the fact that he or she only faces limited liability If the business goes bankrupt or is sued, the limited partner is only liable up to his investment in the business and the business's assetsAre LLC and LTD the same?A limited partnership is a business entity that consists of at least one general partner and one or more limited partners Typically the general partner is an experienced businessperson who provides both financial resources and daily management skills to your limited partnership

Labuan Partnerships Jtc Kensington

What Is A Limited Partnership Type Of Partnership In Business

A limited partnership can indirectly avoid unlimited liability of the general partner if the general partner is a corporation ANS T 158 10 Entities Edition/Test Bank The limited partnership form provides limited liability for the limited partnersFor a person to be eligible to become a registered agent, the person or corporation must be a resident of the state you intend forming the limited partnership That is to say, the individual or corporation must have a physical address within the state2 The office address where partnership records will be kept;

Limited Partnership Vs General Partnership Ppt Powerpoint Presentation Infographic Template Graphics Download Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Limited Partnerships Chapter 5 Limited Partnerships N Designed

What is a Limited Partnership?A Limited Partnership (LP), as compared to a general partnership, is formed by two or more people doing businessAt least a person must act as the general partner That person must have actual management authority for the dayday activities of the company This is in direct comparison to the other person(s) within the business in the role of a limited partnerA limited partnership is composed of one or more general, and one or more limited partners The general partners have management powers and are responsible for all partnership obligations The defining characteristics of a limited partnership are that limited partners Generally do not participate in the management of the business operations

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/BusinessPartners-ed07ea2c3c6b4699a539a2ab678865a7.jpg)

Limited Partnership What Is It

Limited Partnership Agreement Ppt Powerpoint Presentation Portfolio Inspiration Cpb Powerpoint Templates

Treatment Of Limited Partnership Lp And Limited Liability Company Llc Interests In Bankruptcy San Jose Business Lawyers Blog January 27 17

Pros And Cons Of A Limited Partnership By Allan Lloyd Medium

Death Of A General Partner Or How Not To Plan For Succession In A Limited Partnership New York Business Divorce

General Partnership Vs Limited Partnership Harvard Business Services

Family Limited Partnership Asset Protection Rjmintz Com Asset Protection Law Center

Family Limited Partnership What Is One And How It Protects You

Limited Partnerships

What Is A Limited Partnership General Partnership Vs Limited Partnership

Limited Partnerships A Brief Explanation Ionos

Difference Between General Partner And Limited Partner Difference Between

Limited Partnership Example Advantages Vs General Partnership

Limited Partnership Stock Illustrations 136 Limited Partnership Stock Illustrations Vectors Clipart Dreamstime

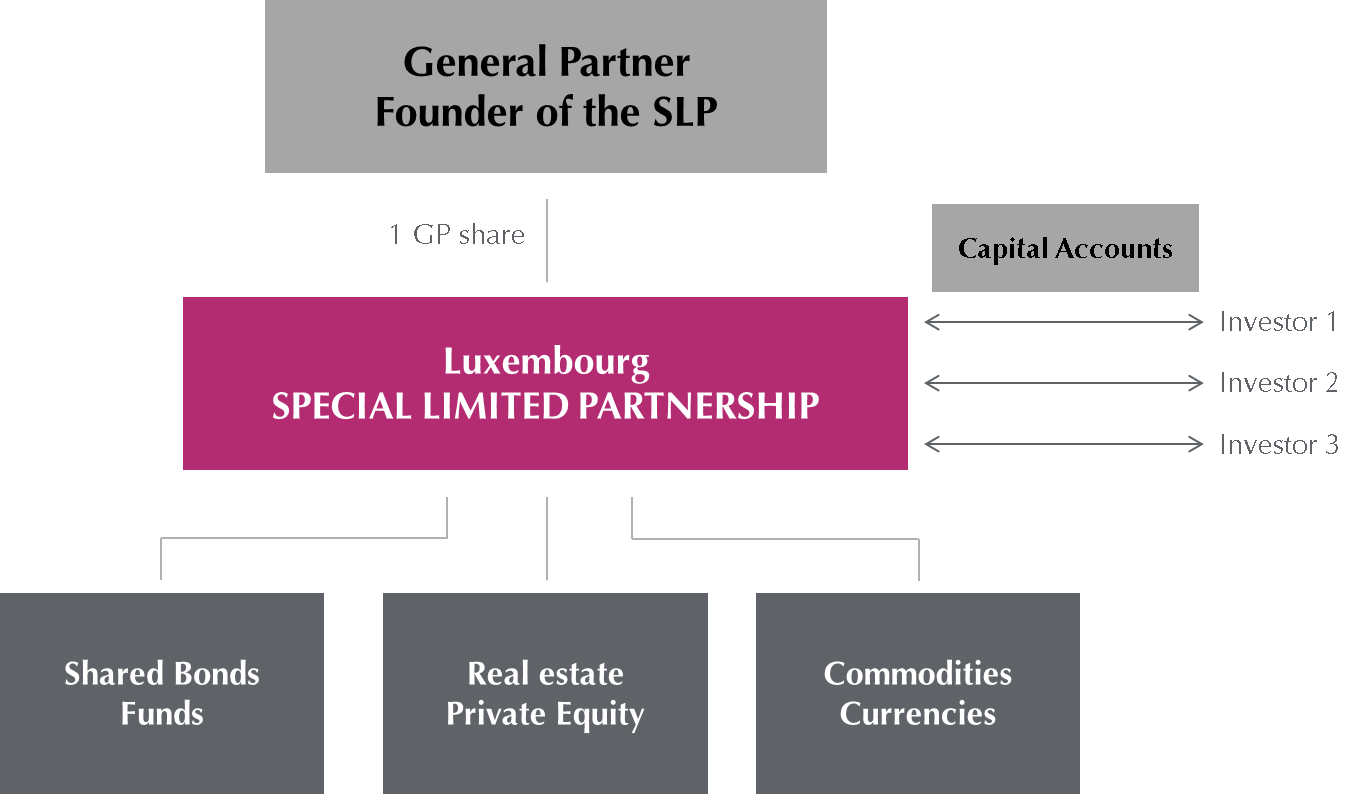

Special Limited Partnership Capital Account

An Introduction To Limited Partnership Funds Who Does What Lcn Property

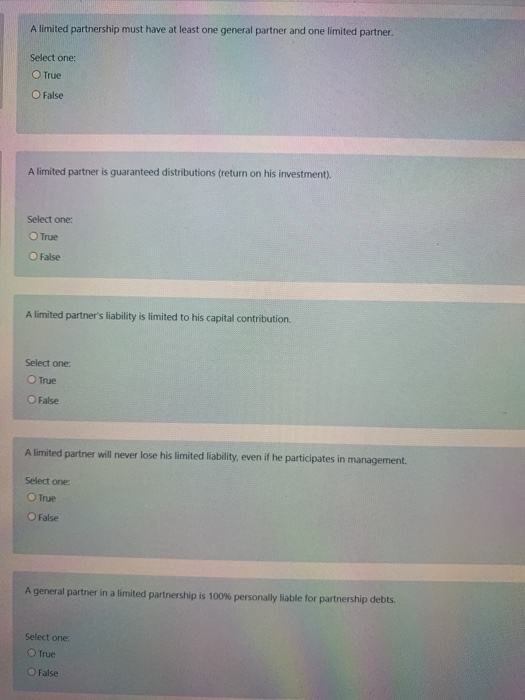

Solved A Limited Partnership Must Have At Least One General Chegg Com

What Is A Limited Partnership Business Archives Alcor Fund

Family Limited Partnerships Pros And Cons Advisors To The Ultra Affluent Groco

Limited Partnerships A Brief Explanation Ionos

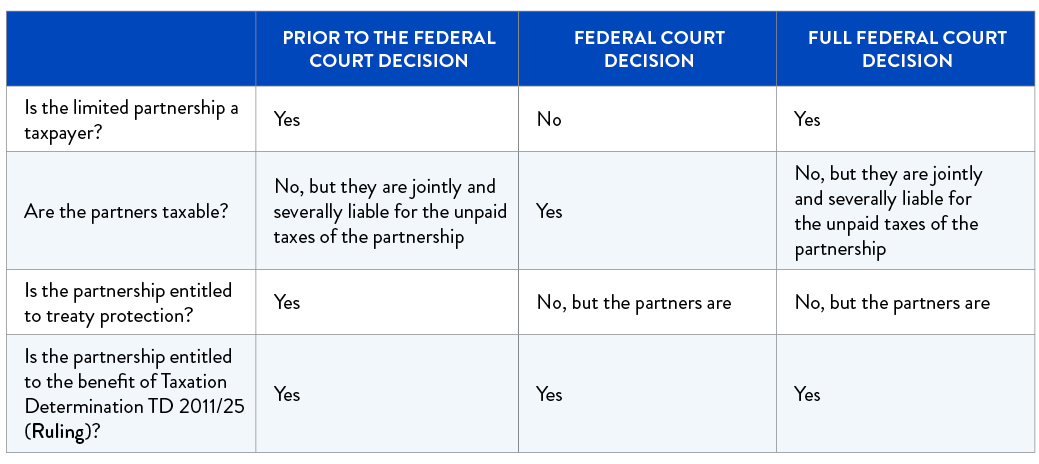

The Taxation Of Limited Partnerships Gilbert Tobin Lawyers

Limited Partnership Certificate Template Free Fillable Pdf Forms Certificate Templates Limited Partnership Templates

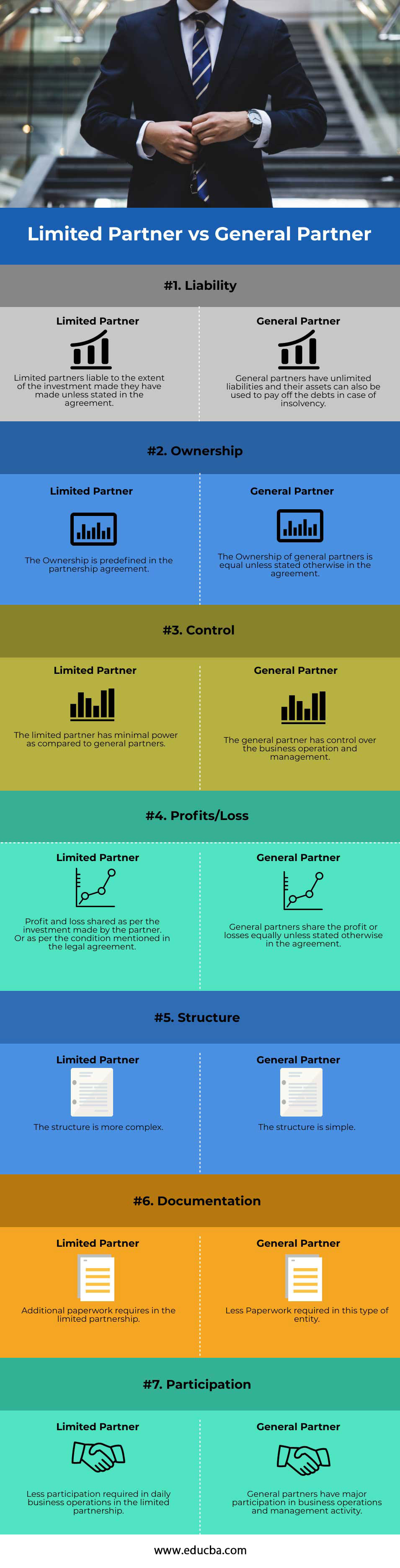

Limited Partner Vs General Partner Top 7 Differences You Should Know

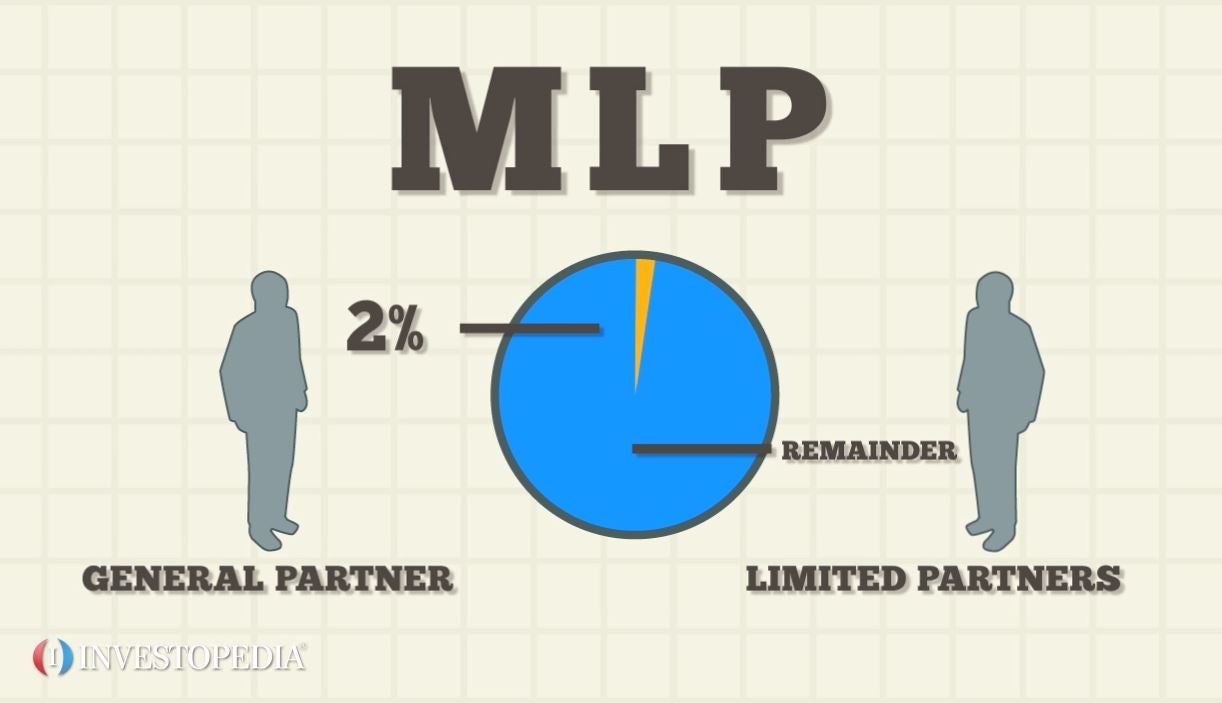

Master Limited Partnerships Prepnuggets

Limited Partner Vs General Partner Top 7 Differences You Should Know

Pdf Limited Partnership A New Business Vehicle In People S Republic Of China

Limited Partnerships Lp Ppt Download

Is A Limited Partnership Right For My Business Legalzoom Com

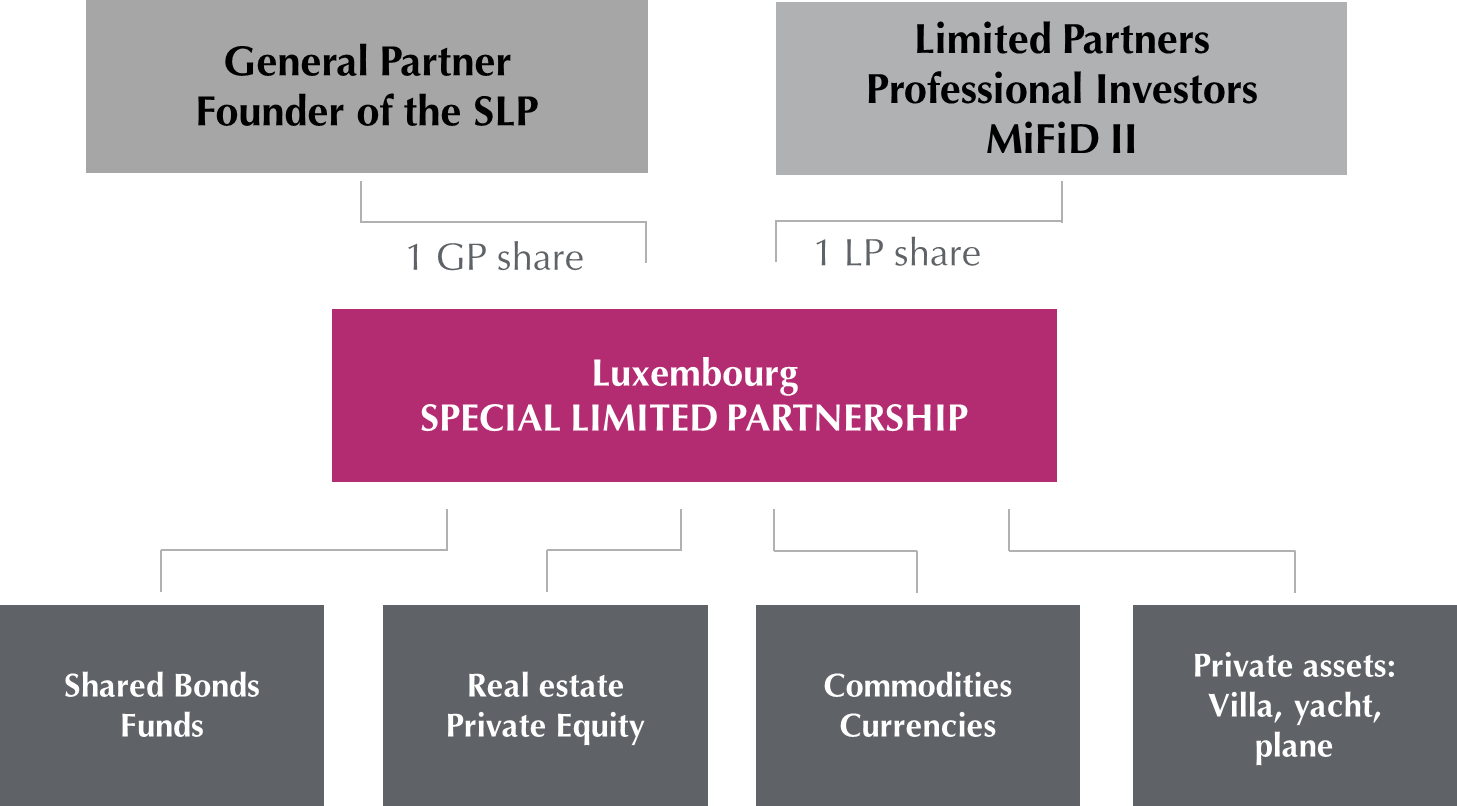

Special Limited Partnership Slp

Financing Our Energy Future Act

Limited Partnership Fund Structure Adapted From Mccahery And Download Scientific Diagram

How General And Limited Partnerships Work Introduction To Legal Structures Youtube

The Cayman Islands Exempted Limited Partnership Desfran

What Is A Limited Liability Partnership Definition Advantages Disadvantages Video Lesson Transcript Study Com

Limited Partnership In Poland

What Is Limited Partner Lp Capital Com

Difference Between General And Limited Partnership With Table Ask Any Difference

免费limited Partnership Agreement Example 样本文件在allbusinesstemplates Com

How To Form A California Limited Partnership Incorporation Rocket

Limited Partnership Agreement Download Pdf And Word Agreements Org

Business Entities 101 Partnerships Limited Partnerships And Limited Liability Partnerships Kussmaul Legal

Liberian Limited Partnerships

Limited Partners What Are Your Rights Mercer Capital

What Is An Irish Limited Partnership Mainstream Group

1

What Is A Limited Partnership

Limited Partnership

Limited Partnership Stock Illustrations 136 Limited Partnership Stock Illustrations Vectors Clipart Dreamstime

Limited Partnerships And Private Equity Lival Co

What Is A Limited Partnership Definition Advantages Disadvantages Video Lesson Transcript Study Com

What Are The Characteristics Of A Limited Partnership Or Lp Meg International Counsel Pc

What Is A Limited Partner Liability Rights And Obligations Ionos

Why A Tailor Made Limited Partnership Regime For Funds Is Needed In Hong Kong Ey China

3

New Zealand Limited Partnerships

Limited Partnerships Types Of Business Ownership

Difference Between General Partner And Limited Partner Difference Between

Types Of Partnership Business And Their Characteristics

.jpg?sc_lang=en&hash=812E97C2781FB2EFA73C4F2715549184)

Limited Partnerships And Their Personality Ashurst

Advantages And Disadvantages Of Limited Partnership

Free Limited Partnership Agreement Free To Print Save Download

1

Master Limited Partnership Mlp Definition

Limited Partnerships For Entrepreneurs With Silent Partners

Partnership Overview Of Different Types Of Partnerships

Lp What Is It Where And How To Open A Limited Partnership Internationalwealth Info

Lllp Limited Liability Limited Partnership

Insights European Gateway Eg Newsroom

Master Limited Partnership 5 Characteristics Investors Should Seek In An Mlp The Motley Fool

Limited Partnership Definition What Does Limited Partnership Mean Youtube

4 Types Of Partnership In Business Limited General More

Chapter Four Limited Partnerships Business Entity Created In Accord With State Statutes That Provides Limited Liability To Some Of Its Members Called Ppt Download

What Is A Limited Partnership

Difference Between General Partner And Limited Partner Difference Between

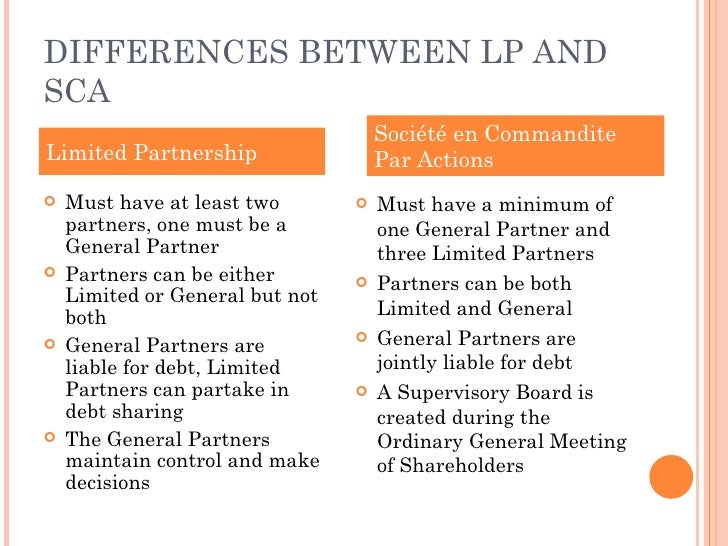

Limited Partnership Or Societe En Commandite Par Actions

Pe Lp And Gp Obor Invest

Sample Limited Partnership Agreement Template

Limited Partnership

Limited Partnership Example Advantages Vs General Partnership

Partnership

Limited Partnership What Is A Limited Partnership And How To Form One Nerdwallet

Comparison Between Limited Partnership Lp And Limited Liability Partnership Llp Ipleaders

0 件のコメント:

コメントを投稿